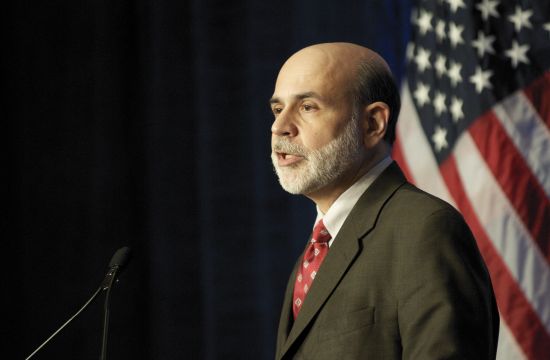

The Chair of the Federal Reserve System offered an analysis of the progress of the recovery of the Great Recession. He said, “Having faced the most serious financial crisis and the worst recession since the Great Depression, our economy has made important progress during the past year. Although the economic stress faced by many families and businesses remains intense, with job openings scarce and credit still hard to come by, the financial system and the economy have moved back from the brink of collapse, economic growth has returned, and the signs of recovery have become more widespread.”

To view additional highlights and excerpts from the event, please click here.